September 07, 2023

The most recent edition of an annual report from the Lincoln Institute of Land Policy and the Minnesota Center for Fiscal Excellence compared effective property tax rates across 53 municipalities in all 50 U.S. states. The report found that property tax rates vary greatly by city and state, and the variance was correlated with several local contextual factors, including a government’s reliance on property taxes compared to other types of taxes, variance in property values, levels of local government spending and whether or not classification is used to tax residential or other types of property at lower rates.

An effective property tax rate is the percentage of a property’s full market value owed in property taxes during a given tax year. Multiplying the market value of a home or business property by the applicable effective tax rate provides an estimate of property taxes due on that property in a given year. For example, a property with a market value of $300,000 and an effective tax rate of 2% would have an estimated property tax liability of $6,000.

By standardizing the expression of property tax burden, effective property tax rates provide a method of comparing average property tax burdens in different areas over time. However, these are estimates for the purpose of broad comparison rather than precise expressions of tax burden on specific properties. An effective tax rate for a specific property can be calculated by dividing that property’s most recent annual tax liability into an estimate of its market value in the same year.

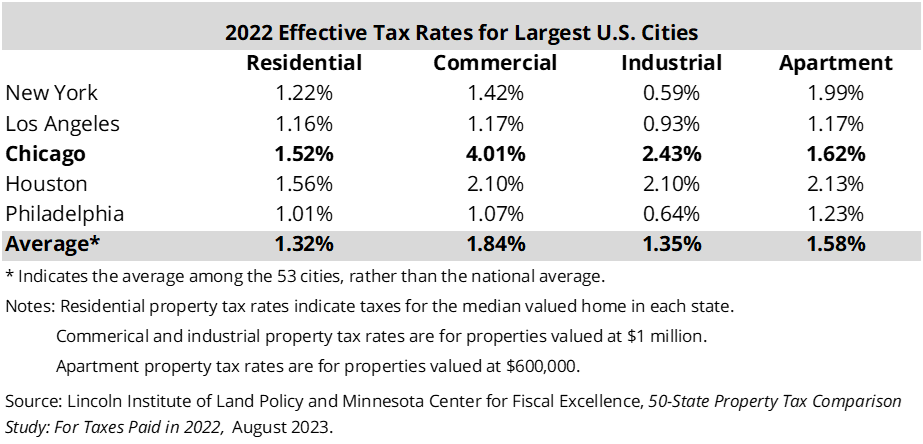

Using the data provided in the Lincoln Land Institute report, this blog examines the effective property tax rates of the five largest U.S. cities, noting how Chicago compares with these cities and the average of the 53 cities in the report. The table below compares the effective tax rates of residential, commercial, industrial and apartment properties. It is important to note that the tax structures in each state vary greatly, which makes drawing conclusions from direct comparisons challenging.

For more detailed information on local effective tax rates, see the Civic Federation’s report on Estimated Effective Property Tax Rates.

Residential Property Tax Rates

Chicago’s 2022 effective tax rate on median valued residential properties was 1.52% for homesteads, or primary residences occupied by property owners. The average among all cities was 1.32%. Among the five largest U.S. cities, only Houston had a higher residential tax rate at 1.56%. New York has the third-highest rate of 1.22%, or 0.3%, below that of Chicago.

Commercial Property Tax Rates

Chicago’s 4.01% effective tax rate on commercial properties is more than twice the average of the 53 cities and nearly double the rate of the second-highest of Houston (2.10%). These averages are for commercial properties valued at $1 million without on-site inventory. The report attributes Chicago’s rate to high levels of local government spending and a higher tax burden on businesses due to the property classification system.

Industrial Property Tax Rates

For industrial properties valued at $1 million, Chicago’s effective tax rate of 2.43% is also the highest among the five largest cities, and more than a percentage point above the 53-city average of 1.35%. The report noted that industrial property tax rates varied widely by city and state.

Apartment Property Tax Rates

Chicago’s 1.62% effective tax rate for apartment properties valued at $600,000 is third among the five largest cities and slightly above the 1.58% average among the 53 cities. The report further noted that Chicago’s effective property tax rate for apartments increased by 24% from 2021 to 2022 based on an increase in the apartment assessment ratio that was higher than those of other types of property classifications.

Again, it should be noted that effective property tax rates should be regarded only as estimates for several reasons, particularly in the Chicago region:

- There are multiple property tax rates within each municipality, and the effective tax rate is representative of only one of those tax rates;

- Effective property tax rates for residential properties do not include homestead, senior or other exemptions; and

- The effective tax rate calculations utilize information on the median level of assessment within a given geographic area. While a property is likely to be near the median level of assessment, the actual level of assessment for any given property could be more or less than the median.

The Civic Federation is currently in the process of drafting its most recent report on effective tax rates in Northeastern Illinois for 2020 and will release details as they become available.